- #Benachee resources inc ag growth international drivers

- #Benachee resources inc ag growth international update

At the second customer site, the site of the grain bin incident, the customer has decided to remediate themselves and with other suppliers.īased on remediation work completed thus far, we have recorded an additional $7.5M to the previously disclosed $70M accrual. Work has begun at one of the two customer sites and is expected to be completed by the Fall of this year.

#Benachee resources inc ag growth international update

Update on Remediation Work Progress on advancing the remediation work as it relates to the previously disclosed grain bin incident continued in the quarter. Removing the impact of Farmobile would have resulted in a loss of $0.4M in adjusted EBITDA for the Technology segment in Q2 2021. Adjusted EBITDA for the segment was a loss of $1.9M in Q2 2021 versus a loss of $1.0M in Q2 2020. However, given changes to our sales programs which effected timing of revenue recognition, the Technology segment sales declined by 9% in the quarter on a comparable retail equivalent basis. Our "as reported" Technology segment sales increased 58% YOY. Deepening the integration of Farmobile and AGI SureTrack technologies will create the next generation of market leading products and accelerate overall commercialization. Work also began on the integration of Farmobile into the AGI SureTrack platform. The engagement will continue, though at a substantially reduced intensity, for several more months. This extensive effort was supported by our third-party consulting partner and a corresponding $1.2M one-time expense is included in our adjusted EBITDA at the corporate level in the quarter. We also remained focused on onboarding dealers and advancing our distribution channel strategies. Significant production automation initiatives were completed which will reduce costs and increase capacity. Technology Segment The second quarter was marked by significant progress on a variety of strategic priorities to facilitate continued sales growth and margin stability. As of June 30, 2021, the Commercial segment backlog is up 59% over prior year.

The Commercial segment was significantly impacted by rising input prices, steel in particular, which compressed margins in the quarter. In the U.S., we continue to see projects that were delayed due to COVID come to market and generally observe customers returning to more normalized buying patterns. Within the broader Commercial platform, strength in the U.S., APAC, and South American markets was offset by softness in the Canadian market as well as EMEA. and EMEA drove the quarter with increased project work from strategic customers which was augmented by work from new customers. Within the Food platform, strong results in the U.S. Particularly strong sales growth from the Food platform, up 49% YOY, was complemented by a steady overall performance in the Commercial platform, up 7% YOY. As of June 30, 2021, Farm segment backlog is up 90% over prior year.Ĭommercial Segment Commercial segment trade sales and adjusted EBITDA for Q2 2021 grew 11% and declined 22% YOY, respectively. Strong adjusted EBITDA was the result of favourable product mix, sales volume, a disciplined effort on cost containment, and pricing actions.

#Benachee resources inc ag growth international drivers

Robust demand for both portable and farm system products were key growth drivers in the quarter.

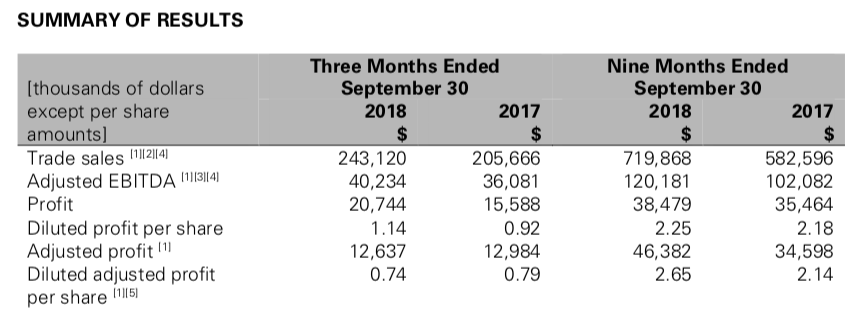

With record backlogs across the business, up 69% over last year, AGI is well positioned for a strong finish to 2021 and going forward."įarm Segment Farm segment trade sales and adjusted EBITDA for Q2 2021 grew 17% and 26% YOY, respectively, with notable strength in U.S. Farm, our Technology business as well as our Food platform underpinned an excellent quarter despite significant supply chain issues globally. "Broad-based growth and market share gains across Brazil, India, U.S. Summary "Our strong second quarter results continue to highlight the benefits of AGI's growth and diversification over the past several years," noted Tim Close, President & CEO of AGI. See "OPERATING RESULTS – THREE MONTHS ENDED JDiluted profit (loss) per share and diluted adjusted profit (loss) per share" in our MD&A. See "OPERATING RESULTS – THREE MONTHS ENDED JEBITDA and Adjusted EBITDA" in our MD&A.

See "OPERATING RESULTS – THREE MONTHS ENDED JTrade Sales" in our Management Discussion and Analysis for the period ended J('MD&A').

0 kommentar(er)

0 kommentar(er)